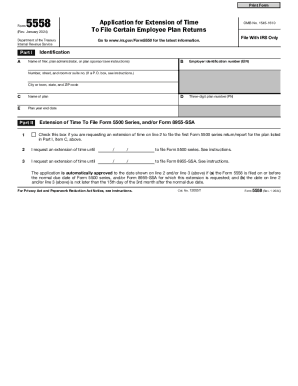

IRS 5558 2025-2026 free printable template

Instructions and Help about IRS 5558

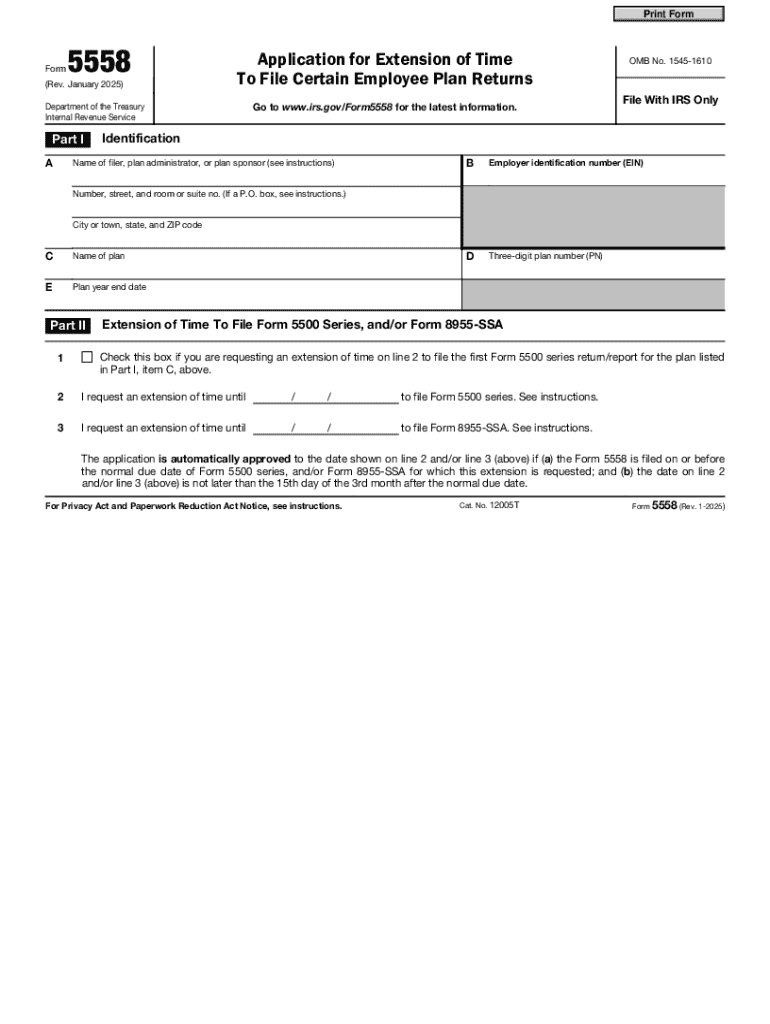

How to edit IRS 5558

How to fill out IRS 5558

Latest updates to IRS 5558

All You Need to Know About IRS 5558

What is IRS 5558?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 5558

What should I do if I realize I've made an error after filing the IRS 5558?

If you discover a mistake after submitting the IRS 5558, you can amend your submission by filling out a corrected form. Ensure you follow the appropriate guidance for amendments to avoid further complications. Keep in mind the tracking methods to confirm the revised form is accepted.

How can I check the status of my IRS 5558 submission?

To verify the status of your IRS 5558, you can utilize the IRS's online tools or contact their helpline for assistance. It is also advisable to track any confirmation numbers provided during the e-filing process to ensure your form has been processed.

Are e-signatures acceptable for the IRS 5558, and what are the privacy implications?

E-signatures are generally acceptable for the IRS 5558, provided they comply with IRS regulations. However, it's crucial to implement necessary privacy measures to protect sensitive information when filing electronically.

What common errors should I avoid when filing the IRS 5558?

Common pitfalls when filing the IRS 5558 include incorrect data entry, failure to double-check deadlines, and not verifying all required information is included. Being aware of these issues can reduce processing delays and minimize the risk of rejection.